Reducing Cost of Capital for PCB Manufacturing Expansion

Why is Reducing the Cost of Capital Critical for MTI’s PCB Manufacturing Expansion?

MTI, a leading PCB assembly manufacturer, is at the forefront of innovation in the electronics manufacturing industry. As the company looks to expand its manufacturing capabilities, reducing the cost of capital becomes a crucial factor in ensuring the profitability and sustainability of its operations. But why is reducing the cost of capital so critical?

Reducing the cost of capital allows MTI to maximize its return on investment (ROI) by lowering the expenses associated with financing the expansion. Whether through debt or equity, the cost of acquiring additional capital directly impacts the company’s bottom line. A lower cost of capital means that MTI can allocate more resources to research and development, process optimization, and quality control—areas essential for maintaining competitive advantages in the highly dynamic PCB manufacturing sector.

How Can MTI Leverage Economies of Scale to Lower Costs?

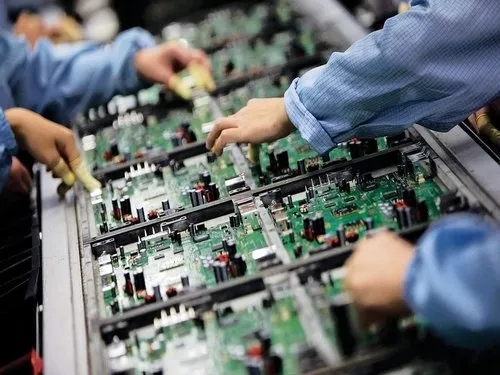

As MTI scales up its production capacity, economies of scale become a significant lever in reducing overall costs. By producing PCBs in larger volumes, MTI can spread fixed costs, such as machinery and factory overhead, over a greater number of units, effectively lowering the per-unit cost of production.

Moreover, bulk purchasing of raw materials such as copper-clad laminates, solder masks, and other components allows MTI to negotiate better pricing from suppliers. This reduction in material costs further contributes to lowering the overall cost of capital, as less financing is required to achieve the same production output. Additionally, MTI’s increased bargaining power with suppliers can lead to more favorable payment terms, improving cash flow and reducing the need for external financing.

What Role Does Technological Innovation Play in Reducing Costs?

Technological innovation is another critical factor in reducing the cost of capital for MTI’s expansion. By investing in state-of-the-art manufacturing equipment and automation technologies, MTI can significantly enhance production efficiency and reduce labor costs.

For example, automated optical inspection (AOI) systems and surface-mount technology (SMT) lines can streamline the PCB assembly process, reducing error rates and rework, which in turn lowers operational costs. Furthermore, the adoption of advanced manufacturing techniques like additive manufacturing and laser direct imaging (LDI) can reduce material waste, further cutting down on costs. These innovations not only contribute to lower capital costs but also position MTI as a technology leader in the PCB manufacturing industry, attracting potential investors and partners.

How Can Strategic Financial Planning Help in Cost Reduction?

Strategic financial planning plays a vital role in reducing the cost of capital for MTI’s PCB manufacturing expansion. By carefully assessing the financial landscape, MTI can identify the most cost-effective financing options available. This might include a mix of debt and equity financing, government grants, or incentives tailored to the manufacturing sector.

A well-structured financial plan allows MTI to optimize its capital structure, balancing the risks and costs associated with different financing sources. For instance, securing long-term debt at favorable interest rates can provide the necessary capital for expansion while minimizing the impact on cash flow. Additionally, MTI can explore options such as equipment leasing, which can reduce upfront capital expenditures and preserve cash reserves for other strategic investments.

How Can MTI Utilize Tax Incentives and Subsidies?

Tax incentives and government subsidies are powerful tools that can help MTI reduce its cost of capital. Many governments offer financial incentives to companies that invest in manufacturing, research and development, and job creation. By taking full advantage of these programs, MTI can offset some of the costs associated with its expansion.

For instance, tax credits for research and development (R&D) can reduce the overall tax liability, freeing up capital that can be reinvested in the business. Similarly, subsidies for energy-efficient manufacturing equipment can lower both the initial investment and the ongoing operational costs. MTI should actively seek out and apply for these programs to minimize its capital costs and enhance its competitive positioning in the market.

How Does Efficient Supply Chain Management Impact Cost?

Efficient supply chain management is crucial in reducing the overall cost of capital for MTI’s PCB manufacturing expansion. By optimizing its supply chain operations, MTI can ensure that materials and components are sourced at the best possible prices, delivered on time, and managed with minimal waste.

Implementing just-in-time (JIT) inventory management practices can reduce the need for large inventory holdings, thereby lowering storage costs and reducing the amount of working capital tied up in inventory. Additionally, strong relationships with key suppliers can lead to more favorable terms and conditions, such as extended payment periods, which can further reduce the need for external financing.

What Are the Long-term Benefits of Reducing Cost of Capital?

The long-term benefits of reducing the cost of capital for MTI’s PCB manufacturing expansion are substantial. A lower cost of capital translates into higher profitability, enabling MTI to reinvest in its operations, drive innovation, and expand its market share.

Moreover, a strong financial position allows MTI to weather economic downturns and industry challenges more effectively. By continuously focusing on cost reduction strategies, MTI can maintain a competitive edge, attract top talent, and build a robust portfolio of clients across various industries. In the long run, these advantages position MTI not just as a PCB manufacturer, but as a leader in the global electronics manufacturing ecosystem.